Either a rebound or a breakout imminent on Australia 200 Index

Australia 200 Index is moving towards a resistance line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 9 days and may test it again within the next […]

Huge bullish move on FTSE China A50 Index

FTSE China A50 Index hits 12189.73 after a 1.76% move spanning 2 days.

A potential bullish movement on Australia 200 Index

Australia 200 Index is moving towards a key resistance level at 7803.7598. Australia 200 Index has previously tested this level 4 times and on each occasion it has bounced back off this level. Is this finally the time it will break through?

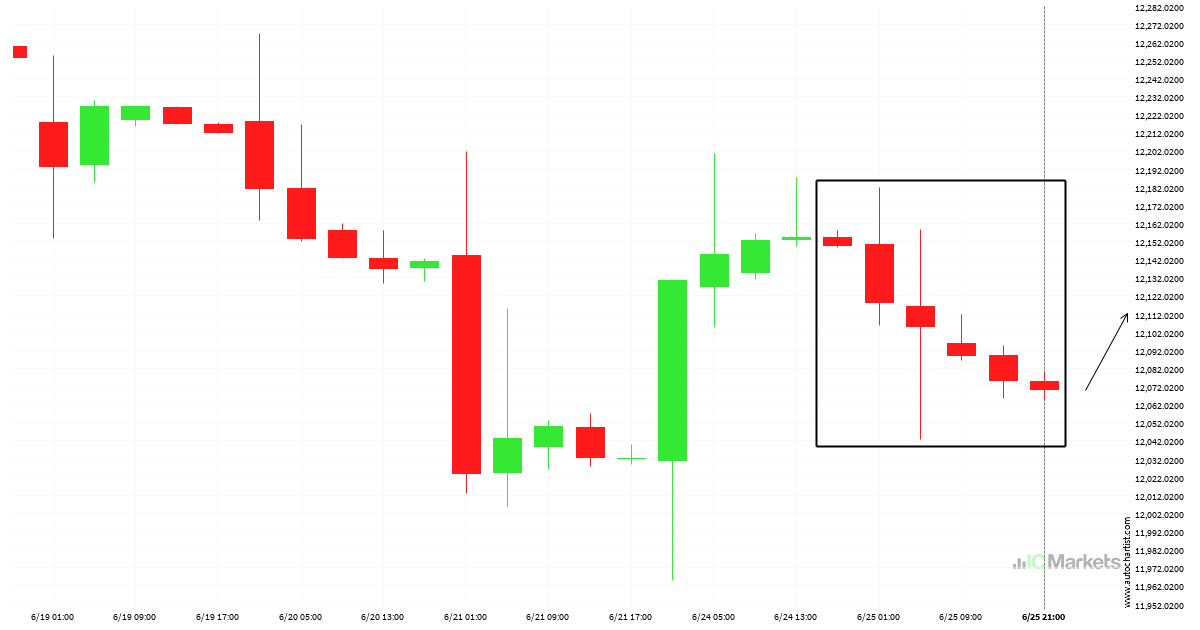

FTSE China A50 Index – support line breached

FTSE China A50 Index has broken through a support line. It has touched this line at least twice in the last 13 days. This breakout may indicate a potential move to 11924.3924 within the next 2 days. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

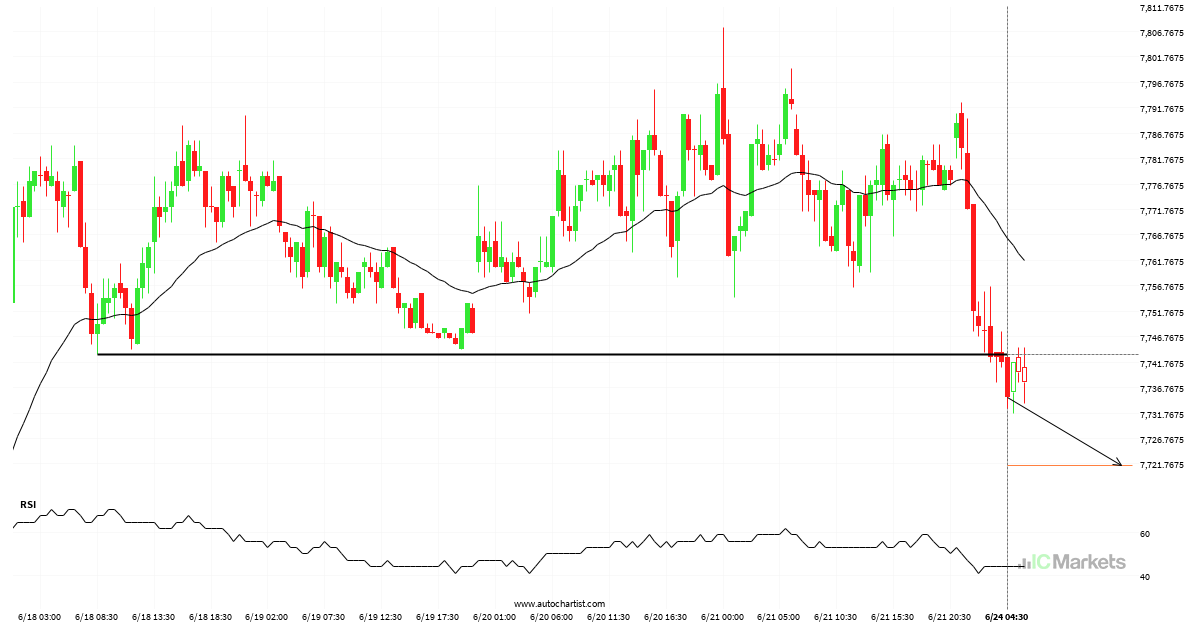

Australia 200 Index – psychological price line breached

Australia 200 Index has broken through a support line. Because we have seen it retrace from this price in the past, one should wait for confirmation of the breakout before trading. It has touched this line numerous times in the last 8 days and suggests a possible target level to be around 7681.2461 within the […]

Should we expect a breakout or a rebound on FTSE China A50 Index?

The movement of FTSE China A50 Index towards 12120.0195 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 20 hours, but it is uncertain whether it will result in a breakout through this line, or simply rebound back […]

Possible start of a bearish trend on Hong Kong 50 Index

Hong Kong 50 Index has broken through 17884.0391 which it has tested numerous times in the past. We have seen it retrace from this price in the past. If this new trend persists, Hong Kong 50 Index may be heading towards 17583.6797 within the next 3 days.

Is FTSE China A50 Index likely to correct after consecutive bearish candles?

FTSE China A50 Index has moved lower after 6 consecutive 4 hour candles from 12154.5200 to 12069.6700 in the last 2 days.

Hong Kong 50 Index – getting close to resistance of a Triangle

Emerging Triangle pattern in its final wave was identified on the Hong Kong 50 Index 4 hour chart. After a strong bullish run, we find Hong Kong 50 Index heading towards the upper triangle line with a possible resistance at 18407.8195. If the resistance shows to hold, the Triangle pattern suggests a rebound back towards […]

Should we expect a bearish trend on Australia 200 Index?

The breakout of Australia 200 Index through the 7743.2500 price line is a breach of an important psychological price that is has tested numerous in the past. If this breakout persists, Australia 200 Index could test 7721.5200 within the next 18 hours. One should always be cautious before placing a trade, wait for confirmation of […]